Ira withdrawal tax calculator 2021

You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until. May not be combined with other offers.

Income Tax Calculator 2021 2022 Estimate Return Refund

Withdrawing money from a qualified retirement account such as a 457 plan.

. You have nonresident alien status. This is in addition to any taxes due. Your life expectancy factor is taken from the IRS.

2021 Estate Income Tax Calculator Rates The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum. IRA Minimum Distribution Calculator Required minimum distribution Calculate your earnings and more The IRS requires that you withdraw at least a minimum amount - known as a. IRA Required Minimum Distribution RMD Table for 2022.

Posted on November 29 2021 by. May not be combined with other offers. As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for.

The 10 additional tax is charged on the early distribution amount you must include in your income and is in addition to any regular income tax from including this amount in income. Ira withdrawal tax calculator 2021. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

Withdrawing money from a qualified retirement account such as a 457 plan. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Estimate your tax withholding with the new Form W-4P.

Email resignation vig vs vym weather in charlottesville baylor university cost. Account balance as of December 31 2021. 2021 Early Retirement Account Withdrawal Tax Penalty Calculator Important.

Calculate the required minimum distribution from an inherited IRA. If you are hoping to withdraw funds before you reach the age of 59 ½ distributions may be subject to a 10 penalty. How is my RMD calculated.

Early Withdrawal Penalties The penalty as of 2021 is 10 if you take a distribution before you reach age 59 12. You are retired and your 70th birthday was July 1 2019. Posted on November 29 2021 by.

Because you got a tax break on it when you contributed traditional IRA money may be subject to taxes when you withdraw it. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Ira withdrawal calculator 2021 Minggu 04 September 2022 Edit. The 2 trillion CARES Act wavied the 10 penalty on early withdrawal s from IRAs for up to. Calculate Your Tax Year 2022 Required Minimum Retirement Distribution.

Ira withdrawal tax calculator 2021. With a traditional IRA withdrawals are taxed as regular income not capital gains based on your tax bracket. For a Traditional IRA you can contribute up to 6000 for the tax year 2021 and 6000 for the.

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Social Security Tax Torpedo

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

2021 Estate Income Tax Calculator Rates

:max_bytes(150000):strip_icc()/tax_calculator-5bfc325046e0fb00260c61ae.jpg)

Guide To Income Tax

How To Calculate Income Tax In Excel

Federal Income Tax Calculator Atlantic Union Bank

Tax Calculator Estimate Your Income Tax For 2022 Free

Simple Tax Refund Calculator Or Determine If You Ll Owe

How To Calculate Income Tax In Excel

Easiest 2021 Fica Tax Calculator

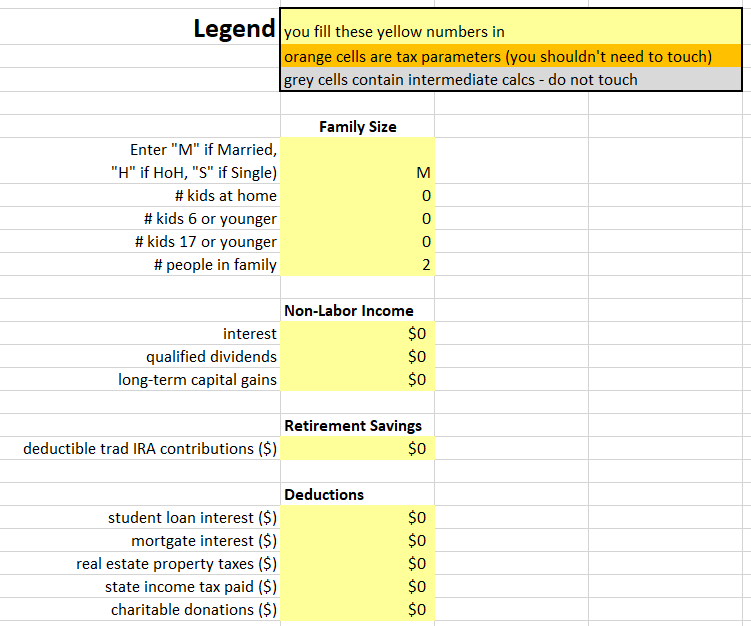

2021 Tax Calculator Frugal Professor

Cryptocurrency Tax Calculator 2022 Quick Easy

2021 Tax Calculator Frugal Professor

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Tax Calculator Estimate Your Income Tax For 2022 Free

Tax Rate In The Usa