Mortgage lending capacity

Chances are you need a mortgage to make the purchase. Just 10 days after announcing it would shutter its wholesale lending.

What Can Affect Your Borrowing Power

Capacity Lending LLC NMLS 1389331 is a residential mortgage company licensed in the state of Texas.

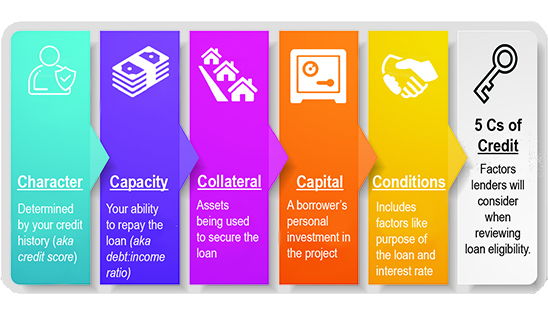

. The 5 Cs of Mortgage Lending. In this first blog of the series we will explore the first C which. The 5 Cs of Mortgage Lending.

Check out the webs best free mortgage calculator to save money on your home loan today. Youll be delighted at how easy it is to find the right loan to fit your. So in a series of blogs I am going to go over one of my first and core lessons on mortgage lending The 3 Cs which are.

The principles of mortgage lending. This minimum lending amount covers most US. Regulation Z in the Truth in Lending Act arms.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current. The federal government regulates the mortgage industry through a number of acts passed by Congress. The 5 Cs of Mortgage Lending.

For 2022 the FHA floor was set at 420680 for single-family home loans. The company said loan origination volume in the quarter totaled just under 16 billion down nearly 26 from the first quarter and down nearly 54 from the second quarter of. As a result mortgage lenders can view accurate data immediately.

As your trusted mortgage advisor we will review your mortgage options through your eyes and with your goals in mind. Mortgage lending 30 focuses on using open banking to input data in real-time. According to Freddie Mac a typical mortgage rate for a 15-year fixed loan in 2019 came with a 35 interest rate down a half percentage point from the year before.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. They can also use this data to make. In this series we will look at the basic 4 Cs of lending.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. The FHA ceiling represents the maximum loan amount and. Standards may differ from lender to lender but there are four core components the four Cs that lender will evaluate in determining whether they will make a loan.

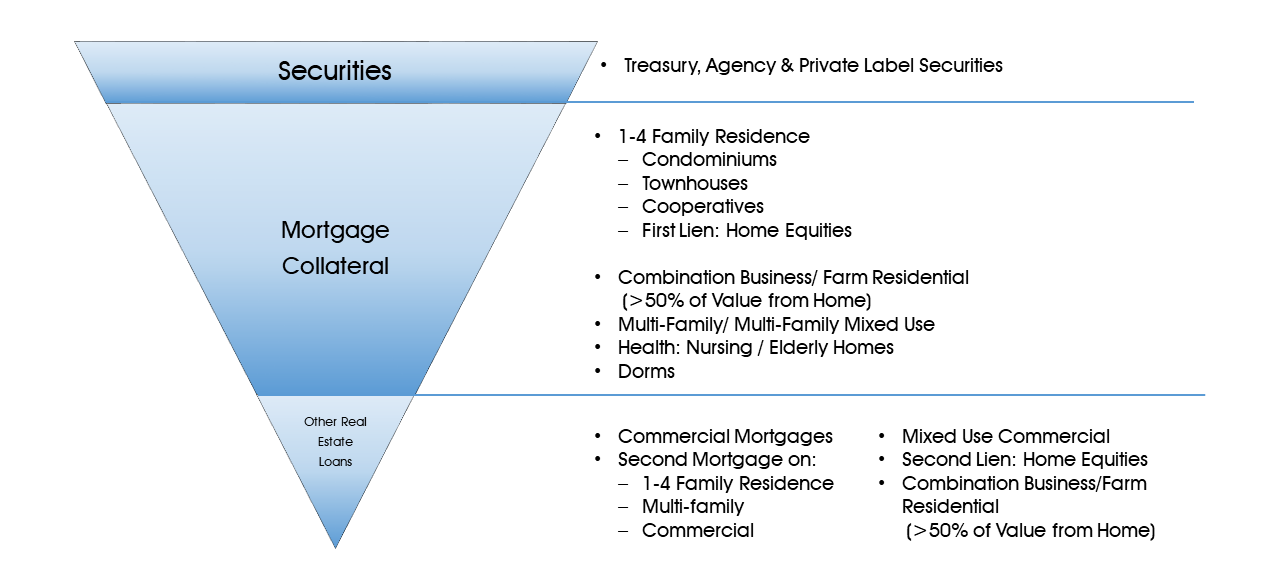

Collateral Guide Federal Home Loan Bank Of New York

47 000 Gone Major New Mortgage Rules From Monday

Accessing Mortgage Financing Options For Buyers Of Shared Equity Homes Grounded Solutions Network

Kh83kuik4sglxm

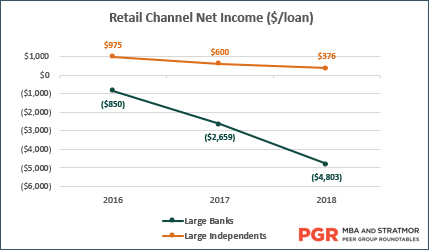

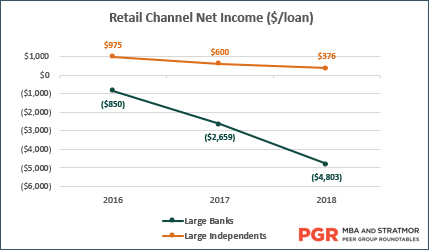

The Large Bank Mortgage Banking Profitability Conundrum Stratmor Group

Tips To Increase Your Borrowing Capacity Your Mortgage

The 5 C S Of Credit Citizens State Bank Financial Blog

Ai And Automation In Loan Origination And Underwriting Capacity

How Do I Get A Loan Approval Credit Capacity Collateral

/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

47 000 Gone Major New Mortgage Rules From Monday

Lvr Borrowing Capacity Calculator Interest Co Nz

Mortgage Serviceability Test Rates Dropped Afford To Borrow More

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

How Much Can I Borrow Home Loan Calculator

Mortgage Industry Underwriting Process And Ways To Improve It